When buying a home - particularly your first home - the mortgage used to finance the purchase is almost as important as number of bedrooms and baths. Unless you are one of the very few first time buyers who will be paying cash (!), the mortgage you can get will dictate how much house you'll buy.

There is no substitute for an in-depth conversation with a professional for understanding how much mortgage you can qualify for. So much depends on how your financial information is packaged and a little shift here or a slight change there can make a big difference. So my first recommendation when buying a home is that you call us at GreatNest and let us work with you to fine tune your mortgage-ability.

One of the things we will look at are your Ratios. You have two of them, a front-end ratio and a back-end ratio. The front-end ratio compares your total projected house payment against your monthly gross income. The back-end ratio compares your total debt, including your projected house payment against your gross income.

Generally speaking, most lenders look for a front end ratio of 29% - 33%. Since most first time buyers gravitate to FHA insured mortgages with their low 3.5% down-payment requirement, we'll use the FHA required front-end ratio of 33% in our example. That means, total projected housing expense, including principal and interest on the mortgage, real estate taxes, HOA dues, homeowner's insurance and mortgage insurance should be in the neighborhood of 33% of your gross monthly income. So, if you are making $60,000 a year ($5,000 a month), your total housing expense should be in the neighborhood of $1,650. How might that break down?

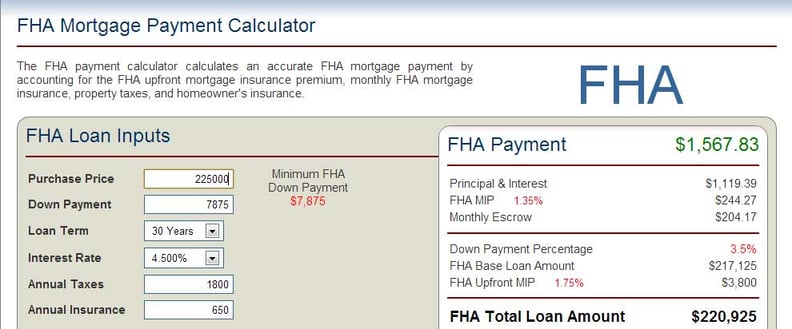

Today's FHA 30 year fixed rate mortgages are running in the neighborhood of 4.5%. So, let's see what kind of payment we'd get with minimum down on a $225,000 house. I'll use the FHA mortgage calculator at whatsmypayment.com:

You can see I 'guesstimated' real estate taxes at $1,800 a year and homeowners insurance at $650. With those parameters, you can see I'm within the $1,650 target my 33% front end ratio set. But even if it had been slightly over this is where professional help comes in. We know dozens of loan products that can take the same set of parameters and yield a lower payment or extend your qualifying ability. If you do the 33% exercise on your own, please understand that you're just getting a beginning, and very rough estimate of your purchasing ability.

Back-end ratios on FHA Mortgage should ideally be in the neighborhood of 43%. That is your total indebtedness - including car payments, credit card payments, alimony and child support payments AND your projected house payment - and it should not exceed 43% of your monthly gross income. In our example, $1,650 constituted 33% of gross monthly income, so we have an additional 10% left for other debts. 12% of $5,000 a month is $500. Debts other than housing expense should not exceed $500 in this example.

Honestly, the back-end ratio stymies more first time buyers than the front-end ratio. Sometimes it's a big payment on a sharp car that breaks the ratio or too much credit card debt. The thing is, it is often possible to work with debt to bring it in line so that a mortgage can be obtained. Often paying off just one credit card can make a huge difference in your ability to qualify. Again, professional help is the way to go here, and at GreatNest, we have it in abundance.

Use the 33% and 43% FHA ratio guidelines to get a feel for your mortgage-ability. Use the various mortgage calculators available online, including those at whatsmypayment.com, bankrate.com and at our preferred lender Caliber Home Loans to fine tune your understanding. But please don't take what any automated system tells you to be the absolute truth. Qualifying for a mortgage is a very human experience and it takes knowledgeable and creative humans to really find a great mortgage: one you can qualify for and with which you will be comfortable.